15+ Find a mortgage

Fixed-rate 15-year Home Loan Calculator. This calculator figures monthly home payments for 15-year loan terms.

Checkbook Register Template For Excel Checkbook Register Budgeting Worksheets Checkbook

The benefit of a fixed mortgage is that you are protected against interest rate fluctuations so your regular payments stay constant over the duration of your term.

. See the table below. The average rate for 15-year fixed-rate mortgages rose by 33 basis points to 459 percent and the average rate for 51 adjustable-rate mortgages rose by 18 basis points to 443 percent. If you can afford it consider taking a 15-year mortgage over a 30-year term.

15-year fixed-rate mortgage-51-year adjustable-rate mortgage-Timespan. What this means. For example lets compare interest costs between a 30-year fixed mortgage and 15-year fixed mortgage with a lower interest rate.

5-year ARMs generally offer a lower initial interest rate compared to fixed-rate mortgages which may save you thousands. 15-year fixed mortgage rates. Freddie Mac reported higher average mortgage rates last week as the rate for 30-year fixed-rate mortgages rose by 23 basis points to 522 percent.

See todays 15-year mortgage rates. The average 51 adjustable-rate mortgage ARM rate is 4520 with an APR of 6290. Mortgage refinance rates fell today bringing 15- and 10-year rates back under the 5 mark.

For a more advanced search you can filter your results by loan type for 30 Year Fixed 15 Year Fixed and 5 Year ARM mortgages. To find great mortgage rates start by using Credibles secured website which can show you. Mortgage refinance rates fell today bringing 15- and 10-year rates back under the 5 mark.

Includes fixed 15-year mortgage rates for conventional FHA and VA loans plus tips to find your best interest rate. Todays national 15-year mortgage rate trends. 30-year benchmarks have increased 227 basis points from this time last year.

What this means. The rate on the 30-year fixed mortgage jumped to 589 from 566 the week prior according to Freddie Mac. Homeowners looking to refinance may find 15-year rates the most appealing as theyre.

The average 15-year fixed mortgage rate is 5330 with an APR of 5360. You will pay more in interest over the life of a 30-year term vs. View complete amortization tables.

Mortgage rates have decreased 9 basis points for 30-year mortgages week over week at 513. 4990 up from 4875 0115. Amortization Tables Loan Balance Interest And Principal.

Find the right loan for you with our full range of mortgage loan options. Determine monthly payments for 5- to 50-year fixed rate mortgage loans. Search and filter all of our resources to find the best ones for you.

Refinance 30-Year Fixed 15-Year Fixed FHA Streamline. A mortgage is a debt instrument secured by the collateral of specified real estate property that the borrower is obliged to pay back with a predetermined set of payments. Fixed mortgage rates.

For today Thursday September 08 2022 the national average 15-year fixed mortgage APR is 5360 up compared to last weeks of 5220. Loan 30-Year Fixed Mortgage 15-Year Fixed Mortgage Difference. Current Mortgage and Refinance Rates.

YOUR LOCAL LEADER IN HOME FINANCING 800-220-LOAN 5626. Fixed mortgage rates are a historically popular option with 5-year fixed mortgage rates accounting for 60 of all mortgage requests made on Ratehubca in 2021. Total Mortgage Services is a national mortgage lender offering some of the lowest mortgage rates available.

10-year fixed mortgage rates. To help you see current market conditions and find a local lender current Redmond 15-year and current Redmond 30-year mortgage rates are. Mortgage Rates See Mortgage Rates Mortgage rates.

Read More California power prices soar to highest since 2020. A 15-year fixed-rate mortgage has a 15-year term with a fixed interest rate and payments while a 5-year ARM has a longer 30-year term with a fixed-rate for the first 5 years and then a variable rate for the remaining term. Homeowners looking to refinance may find that 15-year terms offer the best opportunity.

We are a multi-state mortgage broker headquartered in Kew Gardens New York and is the areas largest independent mortgage brokerage firm. The longer term you select the higher the interest rate will be but your monthly payment will be lower.

What You Need To Know About Financing For Your First House Buying A Rental Property Mortgage Rates Today Mortgage Interest Rates

Bill Wolfe Big Valley Mortgage

Pay Off A Mortgage Faster Cents And Family Saving Money Chart Mortgage Payoff Money Saving Tips

Get A Free Mortgage Broker Layout Pack Mortgage Brokers Mortgage Mortgage Humor

21 Mortgage Statistics That Come As No Surprise In 2022

Cost Tracker Templates 15 Free Ms Docs Xlsx Pdf Downloadable Resume Template Templates Excel Spreadsheets Templates

Loan Calculator Templates 7 Free Docs Xlsx Pdf Loan Calculator Car Loan Calculator Loan Payoff

Homeownership Survey Rocket Mortgage

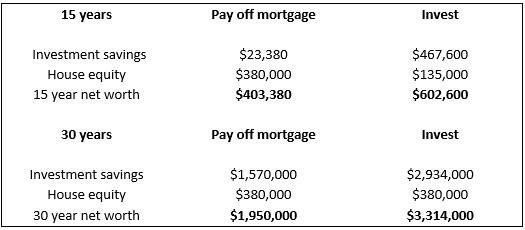

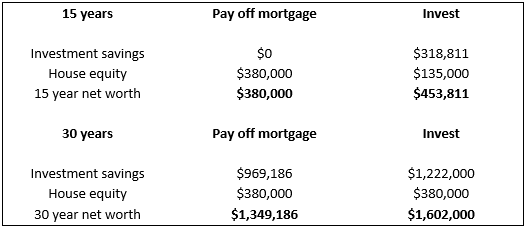

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

15 Versus 30 Year Fixed Mortgage Buckhead Home Loans

Financial Report Monthly How To Create A Financial Report Monthly Download This Financial Report Monthly Template Monthly Template Report Template Templates

:max_bytes(150000):strip_icc()/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

Free Air For Tires Near Me 15 Places To Inflate Your Tires Family Priorities Tired Money Matters

Partners Monthly Budget Template Budget Template Uk Making Own Budget Template Uk To Make A Clear Annual Monthly Budget Template Budget Template Budgeting

Picking A Condo Community Has Its Challenges One Of The Smartest Things You Can Do When Looking For A High Rise C Fitness Facilities Steam Room Swimming Pools

Loan Agreement Templates 15 Free Word Pdf Legal Formats Agreement The Borrowers Mortgage Agreement